The European logistics sector was not immune to the challenges faced by the rest of the commercial real estate sectors in late 2022, including rising interest rates and economic uncertainty. By early 2023, these factors led to lower transaction volumes, price corrections, and higher vacancy rates, particularly in office and retail spaces. However, the logistics sector displayed notable resilience due to the continued growth of e-commerce, efforts to enhance supply chain resiliencies, and an acceleration in reshoring trends, all of which sustained demand for warehousing. With economic activity in some parts of the Eurozone expected to gradually improve in 2024, driven by rising household purchasing power and falling interest rates, logistics real estate is poised to rebound more quickly than other sectors. Here is why:

Logistics real estate in continental Europe has faced challenges but has shown more resilience compared to other commercial real estate sectors

Commercial real estate investment volumes fell significantly in 2023 due to high interest rates and economic uncertainty: €32.7bn were invested in Europe over Q1 2024 which represents a 10% decrease versus Q1 2023 [1].This is the lowest level for a Q1 since 2011. Offices (-27%) continue with the strongest declines due to difficult pricing plus structural changes from energy compliance and hybrid working. Retail (-21%) also saw further fallback. While logistics also saw declines (-4%), it performed better than other CRE sectors and remained investors’ preferred sector in Europe, accounting for 22% of investment in Q1 2024 [2].

The fundamentals have shown more resilience compared to other CRE sectors: logistics is leading rental growth in Europe with a growth rate of 6.8% over the 12 months to Q1 2024, followed by residential (6.3%), and to a much lesser extend offices (2.8%) and retail (1.6%) [3]. Vacancy rates are also holding up better than offices and retail, remaining below 4.5% in Europe in Q1 2024 [4] – to be compared with 8.8% for offices in Q2 2024 [5].

Upcoming macroeconomic recovery poised to boost investment in European Commercial Real Estate

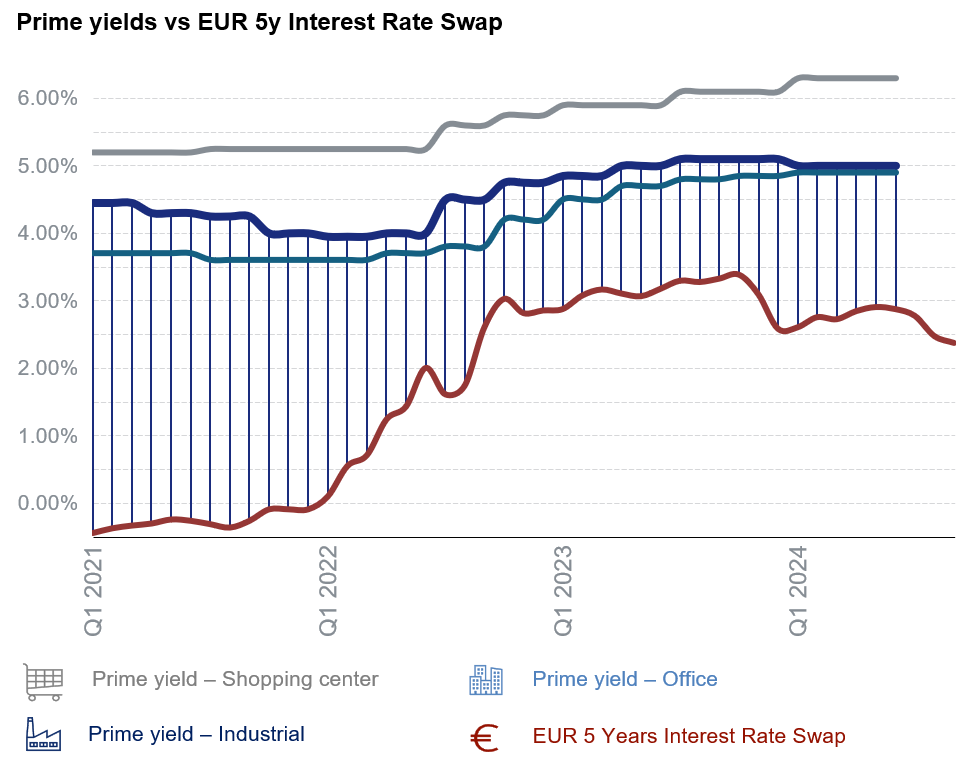

With Eurozone inflation dropping to 1.8% in September 2024, falling below the European Central Bank’s 2% target [6], the ECB is expected to continue its path toward monetary easing. Although Europe still contends with recession risks and sluggish economic growth— with GDP projected to grow by 0.8% in 2024, slightly down from the previous estimate of 0.9% — the yield gap is now back above its long term average, which is likely to stimulate investment activity in 2024 and beyond.

Source:Bloomberg & Savills 2024

Logistics set to lead Commercial Real Estate rebound ?

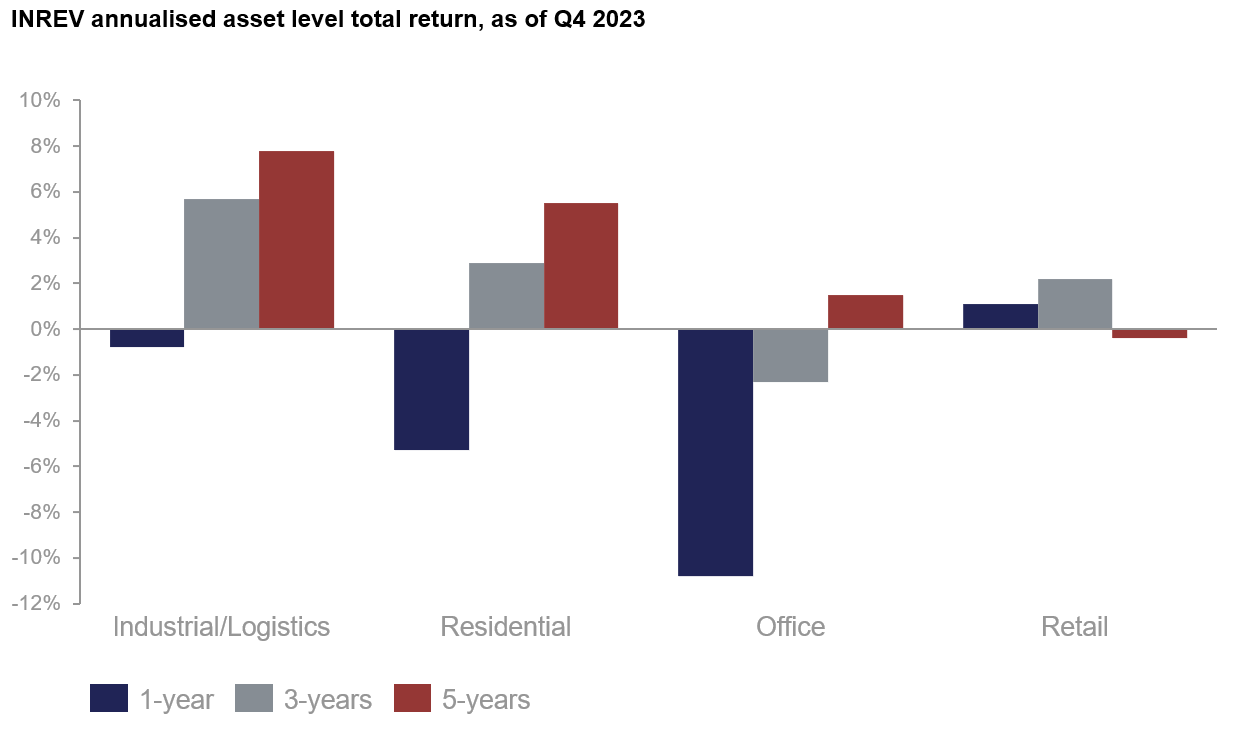

During the previous property cycle, the European logistics sector has already emerged as a standout performer, driven by robust fundamentals and enduring demand trends. Over the past few years, the sector comfortably surpassed benchmarks and other mainstream property sectors:

Source: INREV Clarions Partners Investment Research Q4 2023

The current situation should be no exception to the outperformance of logistics real estate, boosted by its fundamental demand drivers as well as its higher liquidity which led to a faster repricing of logistics RE vs other asset classes since the beginning of the latest cycle of interest rate hikes: valuations have decreased by approximately 21% since their peak as of Q4 2023, compared to a 16% decline for the wider INREV commercial real estate index [7]. This repricing phase is seen as an opportunity for investors, with a forecasted 9.3% annual total return for European logistics in 2024-2028 [8].

In summary, while logistics real estate has faced headwinds along with the broader CRE market, it is poised to be one of the leading sectors in the recovery across Continental Europe due to strong fundamentals and ongoing structural demand drivers. As economic conditions improve, equity-rich investors will likely benefit from attractive opportunities, including forced sales, as some owners may struggle to meet new financing conditions or lack the capital to comply with evolving environmental and technical standards.

[1] Economic Outlook Real Estate Perspectives, BNP Paribas Real Estate, May 2024

[2] European Real Estate Logistics Census, Savills, September 2024

[3] Global real estate market outlook Q3 2024, Aberdeen, July 2024

[4] European Logistics Market Update Q1 2024, JLL, May 2024

[5] European Office Outlook, Savills, August 2024

[6] Eurostat, October 2024

[7] INREV Industrial & Logistics Asset Level Index, Clarion Capital Partners, May 2024

[8] Logistics Remains Favorite As Take-Up And Values Are Projected To Recover, AEW, May 2024