Of all the real estate sectors, logistics has had a particularly buoyant decade: in 2018 for the first time, industrial investment volumes overtook retail, making it the third most-invested asset class after office and residential. The weight of capital targeting European logistics saw yields compress from c. 7% in 2012/2013 to average prime yields of 3.50% in Q2 2022.

Figure 1: Average Prime Yields in Europe

Following a decade of strong returns, 2022 has brought clouds that could put pressure on the sector. Macro headwinds such as inflation, interest rates hikes and financing availability are certainly major drivers for falling investor confidence, not to mention the questions around the potential impact of a slowdown in consumer demand on the very drivers of logistics take-up. Amazon was the first to raise concerns after it recently announced that it had added warehouse space faster than it ultimately needed in response to the challenges of the pandemic. Was the e-commerce trend over-estimated and is there over-capacity in the industry? Is this “the end of the warehouse bubble” as the title of a recent article in the Financial Times[1] suggested?

FACING INFLATION AND INTEREST RATE SHOCK

Like all asset classes, Logistics real estate might (“selectively”, to quote the FT) suffer from interest rate increases and any looming recession, but perhaps not in a systemic way. And perhaps not for long.

An immediate concern is the increasing cost of lending which, in the property sector, might mean that prime yields in core markets may have reached their nadir. In their latest Q2 2022 figures, CBRE reported first signals of what could be a turning point for logistics real estate, with a 25bps quarterly prime yield expansion in the UK and 15bps in Germany.

However, in an exercise assessing the impact on real estate holdings, Kepler Cheuvreux recently performed a simulation on European REITs (June 2022) which indicated that a 250bps increase in financing cost would result in a c. 40% drop in Funds From Operations on average, but pointed out that most REITs would only need to generate 3-5% annual rental growth to offset this.

To start, it is worth noting that inflation should help core European assets in the short term as most continental European leases tend to be better indexed to CPI[2] in comparison with UK, North America or Asia Pacific. In an era of nearly double digit inflation, this has a significant impact on rental levels and should contribute towards offsetting higher rates.

It is also interesting to see that logistics real estate developers, owners and managers such as Warehouses de Pauw (WDP) and Segro (SGRO) recently posted solid results for the first half of 2022. WDP reporting vacancy levels down to 1.1% with 80% of its maturing rent already renewed and its development pipeline 90% pre-let. WDP also reported that rental growth accelerated to 3.1%, helped to some extent by indexation and that it continues to see significant interest from tenants driving high ERV growth.

THE PANDEMIC E-COMMERCE SURGE HAS CORRECTED BUT E-COMMERCE IS ALSO DIVERSIFYING

Whilst it is true that there has been a correction in the pandemic era online surge, on a relative basis e-commerce’s share of total retail sales is expected to continue to rise over time. And there is still plenty of room to grow: in South Korea for instance, e-commerce’s share of total retail sales stands at 37% and is forecasted to increase to 45% in the next 5 years[3].

Figure 2: Share of Online Sales as % of Total Retail Sales

Furthermore, the pandemic’s impact on the growth of e-commerce extends across retailer categories and product lines (with e-commerce across Europe lagging UK growth trends by several years). While Amazon pulls back, other large food and non food retailers have been increasing their take-up of industrial space. Prologis leasing data shows that in the year through Q1 2022, non-Amazon customers accounted for 85% of new e-commerce leases, up from 66% in 2020. Amazon’s proportion of new leasing volume peaked in 2020. Today’s e-commerce customer base is more international in nature and spans a wider range of organizational types, from pure online retailers to omnichannel brands, direct-to-consumer initiatives, and innovative new companies. This trend should support a continued demand for logistics warehouse space with less sensitivity to the macro economic situation.

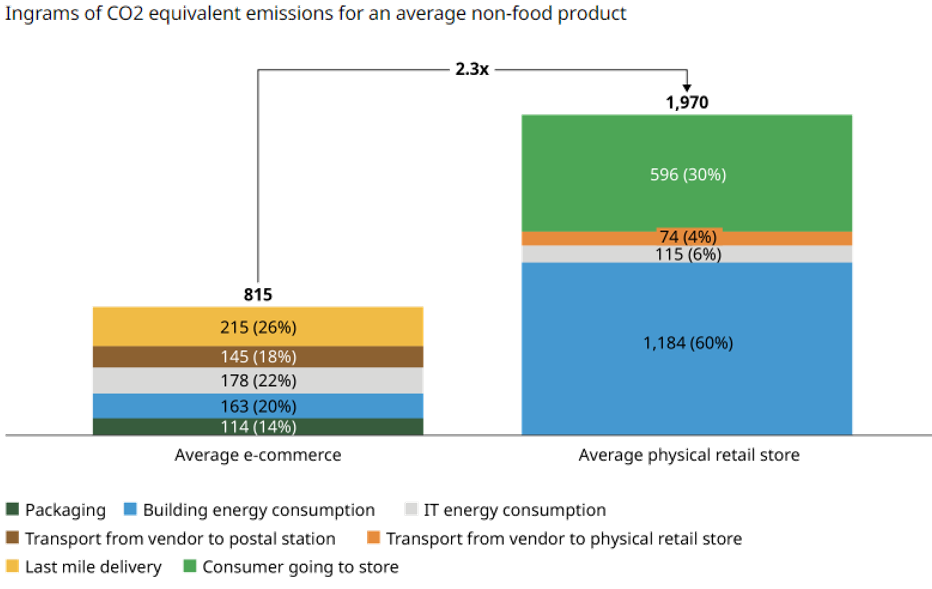

Lastly, it is worth highlighting the positive environmental impact of e-commerce. On average, physical retail shopping emits 1.5 to 2.9 times more CO2e per product sold than e-commerce[4]. While e-commerce needs delivery vans to circulate, these reduce car traffic by between four and nine times the amount they generate.

Figure 3: Oliver Wyman, CO2e impact of a product purchased through different sale channels in Europe

LOGISTICS REAL ESTATE IS NOT SOLELY DRIVEN BY E-COMMERCE. THE SECTOR BENEFITS FORM FURTHER TAILWINDS

Online and omnichannel retailing is bound to develop further for efficiency reasons. Inflation is presently having a big impact on transportation costs which already represents c. 50% of a logistics operator’s cost base. Reducing transportation will not only materially reduce costs, it will also contribute to the supply chain sustainability as occupiers adjust their supply chain with the objective to reduce carbon emissions by optimizing delivery distances. Since rental cost typically makes up less than 10% of this cost base, the upward pressure on rents for well-located warehouses should be easily absorbed.

In addition, the sector is benefitting from a ‘just in case’ response to supply-chain risks and the pressure on corporates to increase strategic stockpiling and inventory building. ING was recently highlighting that changes in inventories in the eurozone were up by 95% in the fourth quarter of 2021 compared to the previous quarter, climbing to the highest level since the beginning of the time series in 1995. The world’s 3,000 biggest companies have increased their holding by the equivalent of 1% of global GDP since 2019, according to The Economist[5].

CONSTRAINTS ON NEW SYPPLY FURTHER STRENGTHEN THE CASE FOR RENTAL GROWTH

The availability of logistical space is projected to stay at record lows. A meaningful increase in supply is unlikely mid-term given stricter lending restrictions, build cost inflation, longer construction lead times, scarcity of suitable land, and municipalities reluctant to zone for large developments.

Since supply is not expected to keep up with demand, rents for more scarce logistics real estate will continue to gradually increase in the next few years. At the moment, the forecasted rental growth remains in the region of 2% to 3% (excluding indexation effect), with variations depending on location.

Considering that, according to the latest CBRE survey, 75% of occupiers are looking to expand their logistics footprint in the next 3 years and 43% are securing sites in advance of requirements, the scarcity of urban logistics sites and increasing rents are making occupiers explore expanding outside the traditional logistics hubs but this does not represent an option for omnichannel & online retailers, post & parcels, and 3PLs.

ON THE WHOLE

Although we remain watchful of general economic conditions and retail trends, one segment of the real estate market that is most likely to withstand an economic slowdown is the logistics sector. The European Logistics sector particularly stands out as, in addition to better inflation indexing, we should continue to see scope for further rental growth driven by market conditions still defined by historic low vacancy, constraints on new developments, and pent-up demand.

As Morgan Stanley recently concluded in a research note, “The key debate is when, not if, logistics becomes in vogue yet again, which we think is probably when the macro-outlook improves”.

Notes

- The Financial Times, August 2022, The end of the warehouse bubble

- Savills, December 2021, “Europe provides the best inflation hedge in comparison with North America or Asia Pacific” Savills UK | Savills benchmarks global real estate assets on resilienc…

- Morgan Stanley, June 2022, Global Ecommerce Growth Forecast 2022 | Morgan Stanley

- Oliver Wyman, 2021, Is e-commerce good for Europe?

- The Economist, June 2022, The tricky restructuring of global supply chains | The Economist