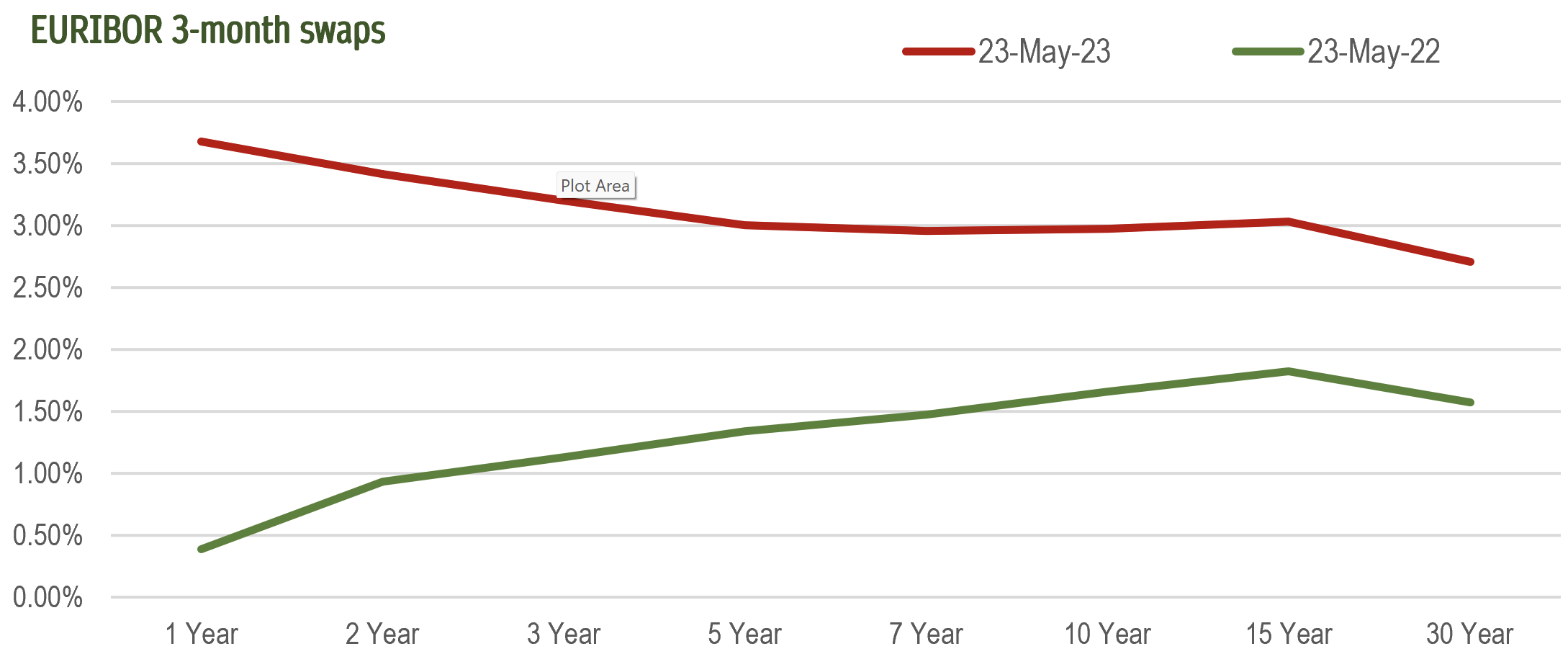

The European Central Bank (ECB) raised its key interest rates by 25 basis points at its May meeting. The ECB has now raised rates by 375 basis points so far and indicated that it might not be over yet (albeit now moving at a slower pace). Also, there is a growing consensus that regardless of its peak, borrowing costs need to remain high to bring inflation back to the central bank’s target. However, with some inflation indicators starting to show moderation, most of the tightening might be behind us.

EURIBOR, May 2023Ref.

Commercial Real Estate

These escalating interest rates, coupled with continuous economic uncertainty, present significant challenges to the commercial real estate market. The commercial property market has around €1.5tn of debt in Europe alone (with offices being the largest component) with around €310bn of borrowing issued in a typical year.

As central banks continue to drive debt costs higher, the cost of borrowing against prime real estate in Europe has doubled year on year. Bloomberg recently reported that, globally, almost $175 billions of real estate credit is already deemed “distressed”. In addition to higher rates, potentially tighter bank lending standards might lead to even higher costs and reduced liquidity. Office spaces appear to be most vulnerable due to the combined factors of increasing rates, a transition towards hybrid work models and, the costs associated with improving energy efficiency of less-premium buildings.

Impact on Logistics

Amid these broader economic concerns, certain sectors of the real estate market are showing promising potential. Residential real estate, for instance, is seen as having greater income stability than its commercial counterparts. Specialized sub-sectors, particularly industrial and logistics assets, are generating specific interest. The current market conditions may potentially present lucrative buying opportunities for core investors still under-allocated to the Industrial/Logistics sector. As an indication, Blackstone’s logistic portfolio allocation has reportedly swollen from nil to 40% in recent years and, with the latest BREP X fund raising $30.4 billion, that potentially represents a material allocation to this sub-sector.

In our August 2022 article (Logistics Real Estate Bubble or Secular Trend?), we reflected on the recent interest rate shock, falling investor confidence and potential slowdown in consumer demand with its impact on Logistics real estate. We highlighted the risk mitigation brought by secular tailwinds stemming from the e-commerce expansion trend and warehouse demand diversifying due to cost savings and sustainability goals with an emphasis on proximity to infrastructure and end-consumers.

Nine months later, it might be opportune to reflect on the above. The slowdown did affect logistic real estate users with warehouse operators and parcel-delivery carriers getting pinched by slowing e-commerce growth after online orders boomed during the pandemic. Demand began to tick lower in the second half of 2022 amid the uncertainty around the economy and a deceleration in consumer spending on goods. This correction led to a slowdown in leasing and a slight increase in vacancy rates although declines were coming from record levels and conditions “remain healthy”.

Supply-chain realignment remained a key driver of take-up, while a shortage of quality space has continued to have an impact in key markets. 3PLs remained the major space consumer last year (44% of take-up, with the focus still on location and efficiency gains in a rising-cost environment, along with the shift to online), while manufacturing-related take-up grew, partially offsetting lower retailer/e-commerce demand.

Market Impact

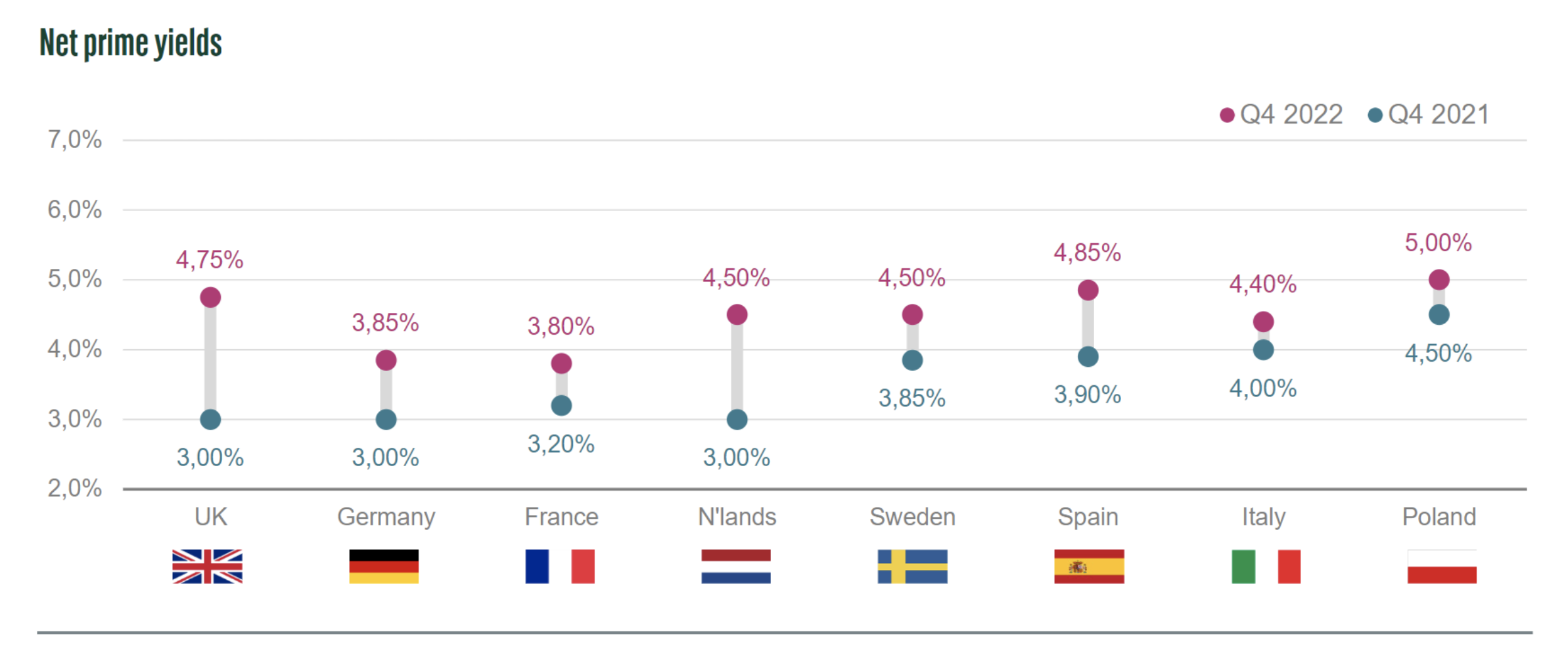

Transaction volumes slowed in 2H22 after a record 1Q22. Property values across the industrial/logistics sector have reacted more or less quickly (depending on the country) to the new market environment as prime yields in Europe widened from a record low with the UK moving by as much as 175bp in FY22 and France witnessing the smallest rise with just 60bp (although, as at 2Q23, it had widened by c. 110 basis points from trough).

BNP PARIBAS REAL ESTATE, February 2023Ref.

Recent REIT reporting from European Logistics owners such as Segro and Warehouse De Paw (WDP) reported early signs of a stabilisation, especially across the UK market and more limited value reductions across Continental European exposures in 1Q23 although overall investment levels/market evidence remains limited. WDP’s reported a 1Q23 like for like rent growth on its portfolio averaging +7.7% (including indexation), but with a marginally lower occupancy rate (98.5% vs. 99.1%).

One element that should draw attention is the new development slowdown. Developpers have reported a significant decrease in their pipeline due to higher cost of capital, inflation and high construction costs, potentially prolonging an ongoing shortfall in logistics space. with WDP stating that, despite a stabilisation in construction costs since Q422, “achieving the targeted returns remains a challenge“.

Occupier Demand has normalised but fundamentals remain

Despite the first adjustments in both online and offline retail, the need for logistics remains largely unchanged so far. For Logistics real estate, the two major factors to bear in mind are the market rent growth being experienced across the sector as well as the insufficient pipeline of new development (especially in urban locations).

Occupier demand has scaled back in line with the medium-term averages, but remains strong across Europe and vacancy remains in check (c.3% for Europe; c.4% UK) and it is expected that rental growth will continue to trend ahead of other real estate sub-sectors. Demand for space increased from tenants looking for efficiency gains. Many seek to get units in their network in the right locations to increase delivery speed to customers.

Nearshoring of manufacturing has also started to benefit the Logisitics market, including demand from food production, automotive and pharma in the UK, according to Savills. Similarly, Cushman & Wakefield’s UK-based industrial/logistics team has been receiving a larger volume of space enquiries from manufacturing and production businesses. Such trends should also be in play across the wider European market as companies aim to adapt supply chains to avoid/insulate against future potential shocks.

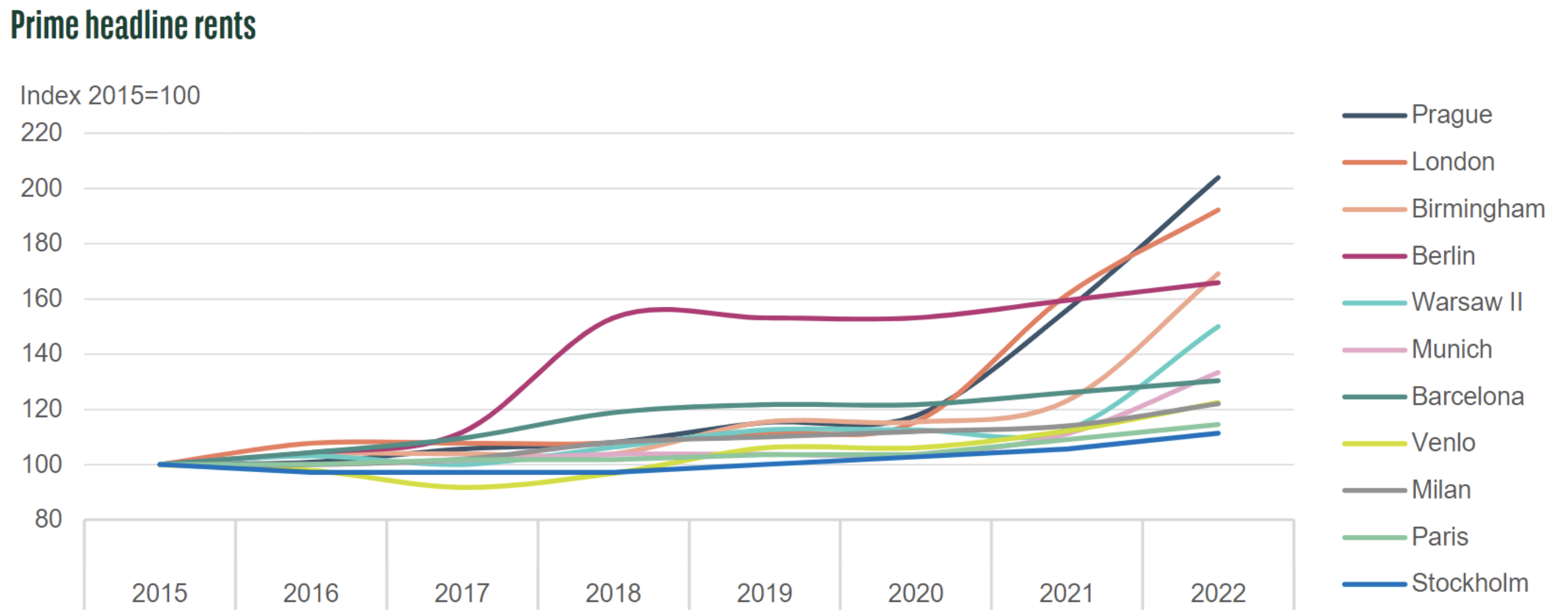

The supply-demand dynamics across the wider market remain and should yield to further rental growth but at varying levels, depending on location. The double-digit annual growth on average across Europe (14% yoy in 4Q22 ) might not be sustainable outside the highest-quality and best-located assets.

BNP PARIBAS REAL ESTATE, February 2023Ref.

Outlook

The logistics real estate sector, particularly last-mile and cross-docking assets in Western Europe, should remain robust due to the ongoing supply-demand dynamics. The sustained rise of e-commerce, continued drive for efficiency and nearshoring trends are supporting European logistics occupier demand. Rising debt rates will continue to influence pricing, creating opportunities for cash-rich buyers with rental growth playing a major part in offsetting this rise over time.

Moreover, development pipeline delays will further stimulate the overall rental growth trend potentially creating severe shortages in some areas over the medium term. Also, investors will find opportunities in retrofitting secondary stock in prime locations to meet the stringent European carbon emissions regulations and occupiers’ increasing ESG criteria.

In conclusion, while the commercial real estate sector faces substantial headwinds in the current economic climate, potential opportunities exist for those prepared to adapt and evolve. As always, a nuanced understanding of the market and strategic planning will be key to navigating these challenges and capitalizing on the opportunities that present themselves.

References

Bayes Business School at City, University of London. BNP PARIBAS REAL ESTATE, C&W, Prologis., JLL , Savills European Real Estate Market Outlook 2023